Challenge

Traditional banks are often designed with the individual consumer in mind and do not typically offer tools or services to support financial interactions with friends and family. This can lead to problems and conflicts, as demonstrated by a study from Bank of America, which found that over half of consumers have experienced the end of a friendship due to money owed, and 43% of Americans would be willing to end a relationship with a friend who has not repaid them.

Research

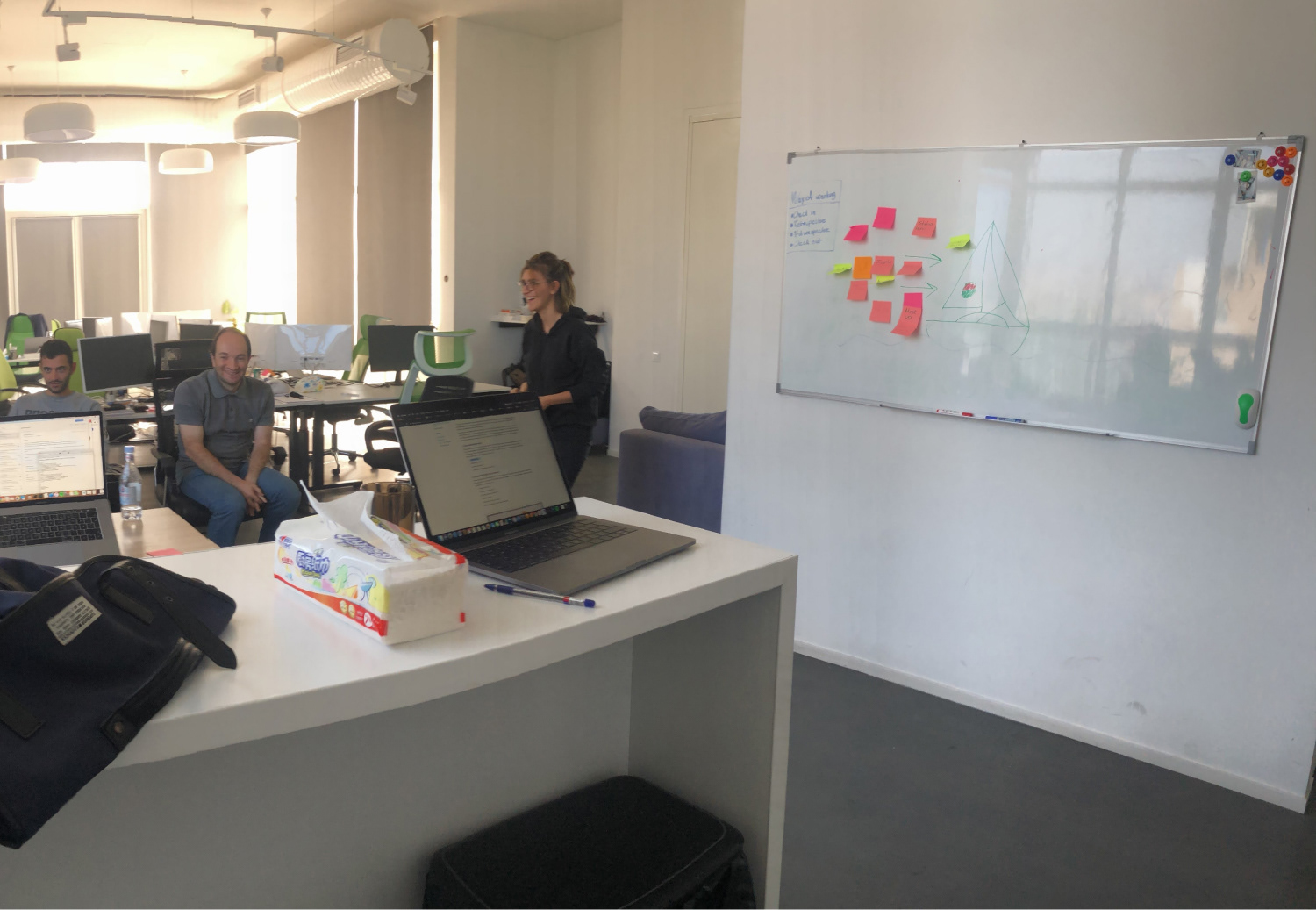

To better understand the users and improve the Steven product, we conducted user interviews and user testing both in-person and remotely. Through these research methods, we gained valuable insights into the users' motivations, needs, and how they incorporate Steven into their daily lives. We used this information to iterate on and improve the existing product, as well as to develop new features.

In addition, we analyzed data in Mixpanel to validate our solutions and identify patterns in user behavior, which helped us to further optimize the product for the users. By combining both qualitative and quantitative research methods, we were able to create a product that meets the needs of the users and addresses their pain points.

The app for shared expenses

Keep track of expenses in real-time, select the ones you want to share with others, and get paid back. Use it when traveling together, arranging a party, or sharing expenses within your household.

Effortless expense sharing

One of its core functions of Steven is the ability to add expenses. To make this process as efficient and user-friendly as possible, we optimized the expense-adding flow to require only two simple steps and immediately focus on key text fields. By prioritizing simplicity and ease of use, we aimed to make Steven a valuable and enjoyable tool for managing expenses.

Automated with open banking

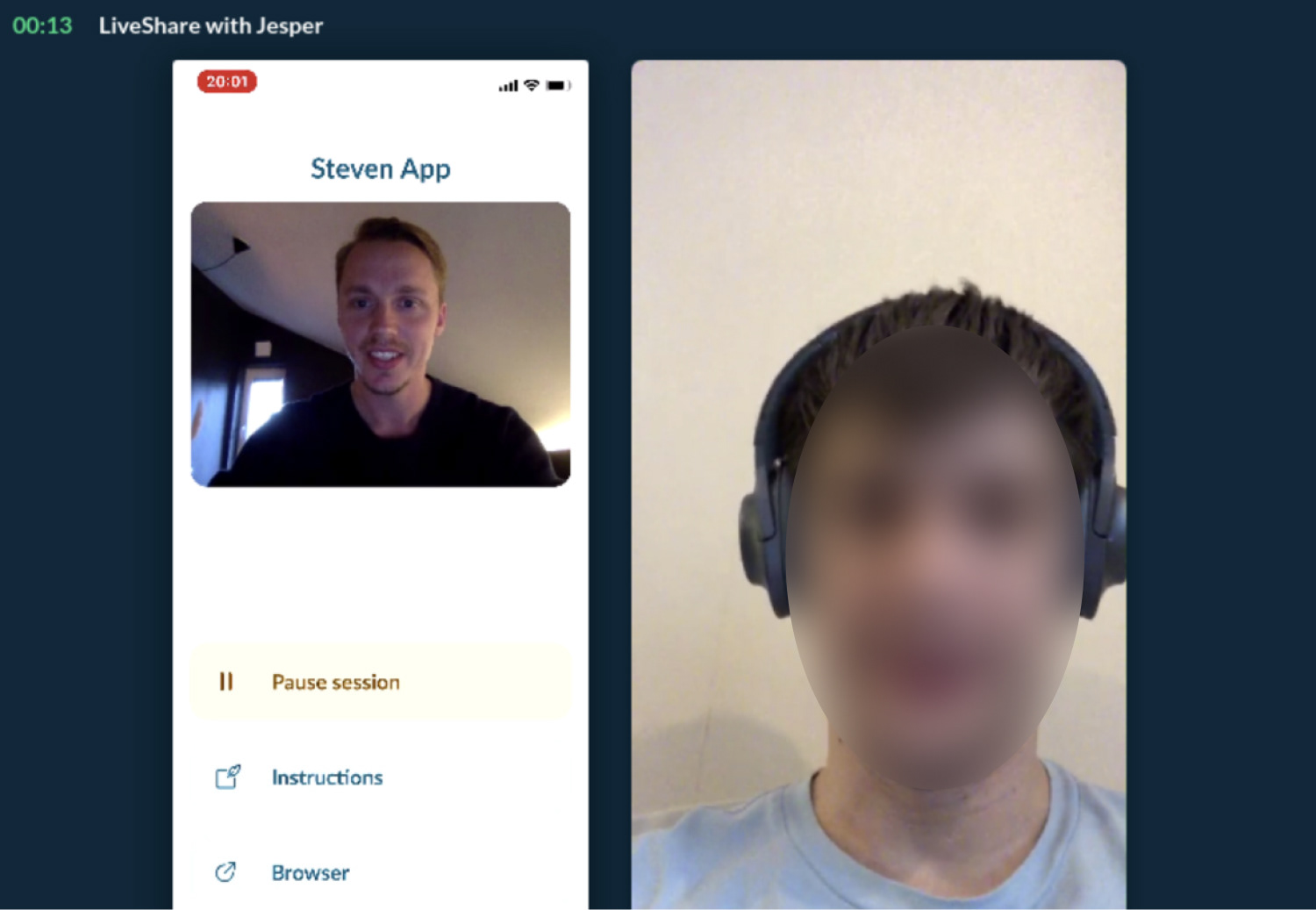

We connected Steven to +15 000 banks and made it possible for the user to connect their bank account with Steven. With this connection, the user can fetch transactions and simply select the ones to be shared. This feature saves time and effort for users and makes it easy for them to use Steven to manage and share their expenses.

Easy to join the party

To increase user growth and make it easier for people to join Steven, we implemented the use of shareable links for invitations.

Previously, users needed to have a phone number to invite new members, which is not always possible. With shareable links, users can easily share the app in chats or pass it along to friends, making it more convenient for others to join. This simple change has helped Steven to attract more users and expand the user base.

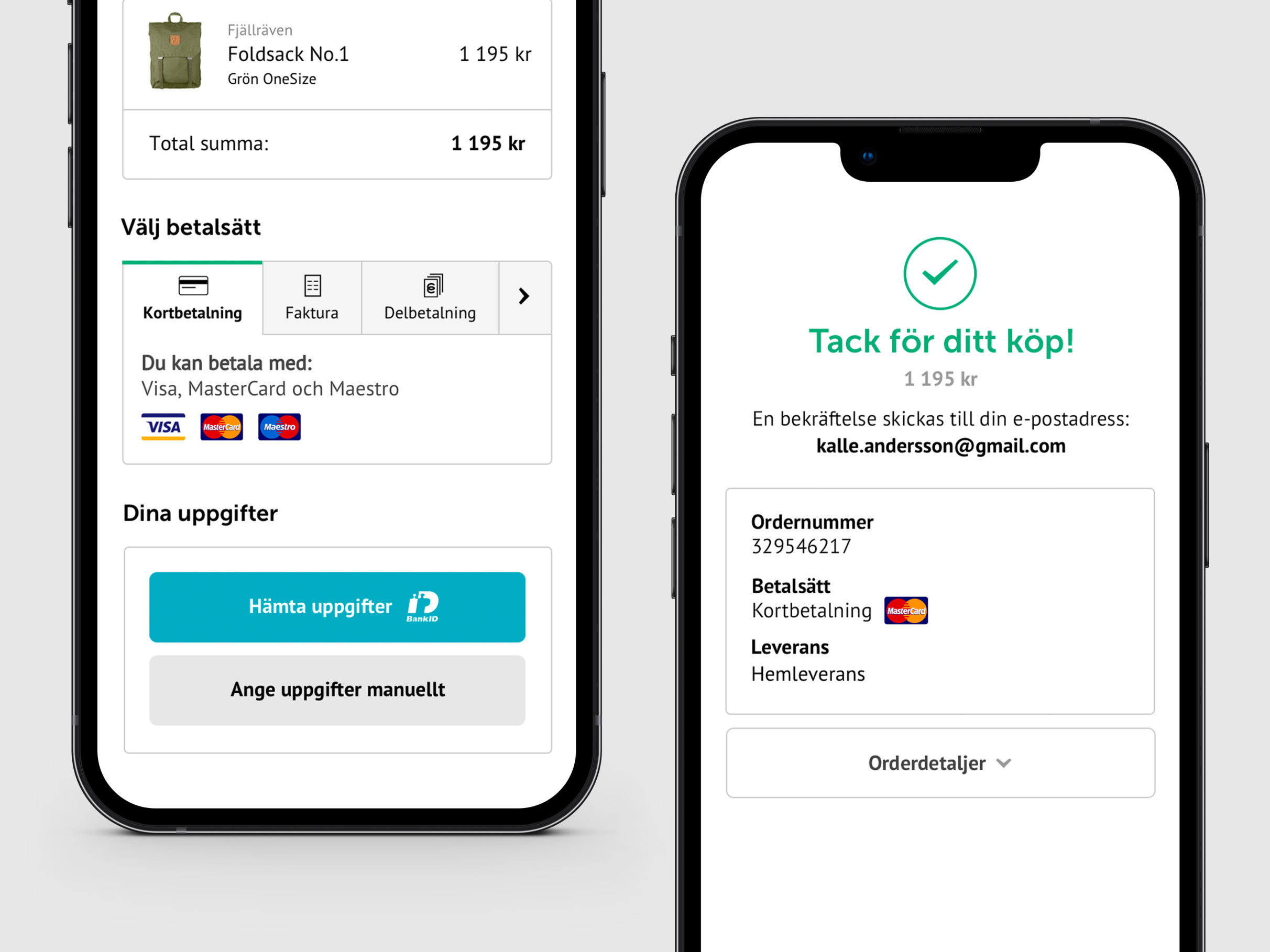

Settle up directly in the app

To make it easy for users to settle up with their friends, we added the ability to do so directly within the Steven app. Using popular payment methods such as Swish and Klarna, users can instantly transfer money and get even with their friends.

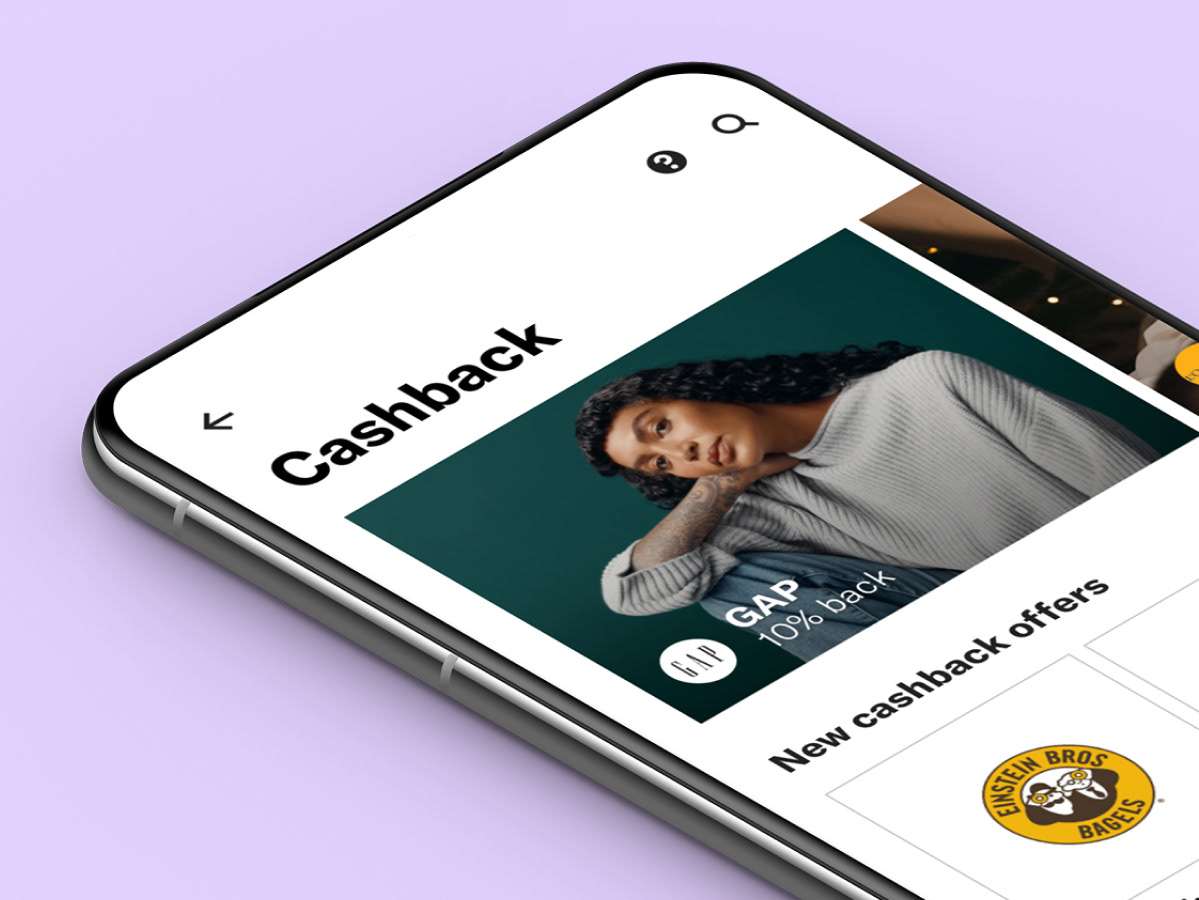

Personalized offers

We created a new revenue stream by integrating personalized offers into the Steven experience in a natural and unobtrusive way. By analyzing user expenses and matching them with relevant offers, we were able to present targeted and useful recommendations to the users. This approach not only helps to drive sales and revenue but also adds value for the users by providing them with personalized and relevant offers that meet their needs.

Get more with Steven Premium

Steven is free for all but for the ones that want automation and power features we introduced a premium plan via Apple Store and Google Play.